Piezoelectric MEMS Resonator Fabrication in 2025: Unleashing Next-Gen Performance and Market Expansion. Explore How Advanced Materials and Scalable Processes Are Shaping the Future of Precision Electronics.

- Executive Summary: Key Insights and 2025–2030 Market Forecast

- Technology Overview: Fundamentals of Piezoelectric MEMS Resonators

- Material Innovations: Advances in Piezoelectric Thin Films and Substrates

- Fabrication Techniques: State-of-the-Art Processes and Yield Optimization

- Competitive Landscape: Leading Manufacturers and Strategic Alliances

- Market Size and Growth Projections: CAGR Analysis Through 2030

- Emerging Applications: 5G, IoT, Automotive, and Medical Devices

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges and Barriers: Reliability, Scalability, and Cost Factors

- Future Outlook: Disruptive Trends, R&D Roadmaps, and Investment Opportunities

- Sources & References

Executive Summary: Key Insights and 2025–2030 Market Forecast

The piezoelectric MEMS resonator fabrication sector is entering a pivotal phase in 2025, driven by surging demand for miniaturized, high-performance frequency control components in wireless communications, IoT, and automotive electronics. Piezoelectric MEMS resonators, leveraging materials such as aluminum nitride (AlN) and scandium-doped AlN, are increasingly replacing traditional quartz-based devices due to their superior integration potential, lower power consumption, and compatibility with CMOS processes.

Key industry players are scaling up production and refining fabrication techniques to meet stringent performance and reliability requirements. Qorvo and TDK Corporation are at the forefront, with Qorvo’s MEMS-based RF filters and TDK’s piezoelectric MEMS platforms targeting 5G, Wi-Fi 6/7, and automotive radar applications. Both companies are investing in advanced thin-film deposition, lithography, and wafer-level packaging to enhance yield and device uniformity. STMicroelectronics is also expanding its MEMS portfolio, focusing on piezoelectric resonators for timing and sensor applications, leveraging its established 200mm MEMS manufacturing lines.

Recent data from industry sources indicate that the global market for piezoelectric MEMS resonators is expected to grow at a CAGR exceeding 20% from 2025 to 2030, with the Asia-Pacific region—particularly Taiwan, Japan, and South Korea—emerging as key manufacturing hubs. This growth is underpinned by the proliferation of connected devices and the transition to higher frequency bands in wireless infrastructure, which demand tighter frequency tolerances and lower phase noise.

On the technology front, the next few years will see further adoption of scandium-doped AlN films, which offer higher electromechanical coupling and improved temperature stability. Companies such as TAIYO YUDEN and Murata Manufacturing are actively developing proprietary processes for these advanced materials, aiming to differentiate their MEMS resonator offerings in terms of performance and reliability.

Looking ahead, the outlook for piezoelectric MEMS resonator fabrication is robust. The convergence of 5G/6G rollouts, edge computing, and automotive electrification will sustain high-volume demand. Industry leaders are expected to accelerate investments in 300mm wafer processing, advanced metrology, and AI-driven process control to further reduce costs and improve device consistency. Strategic collaborations between foundries, materials suppliers, and system integrators will be critical to scaling production and meeting the evolving requirements of next-generation electronics.

Technology Overview: Fundamentals of Piezoelectric MEMS Resonators

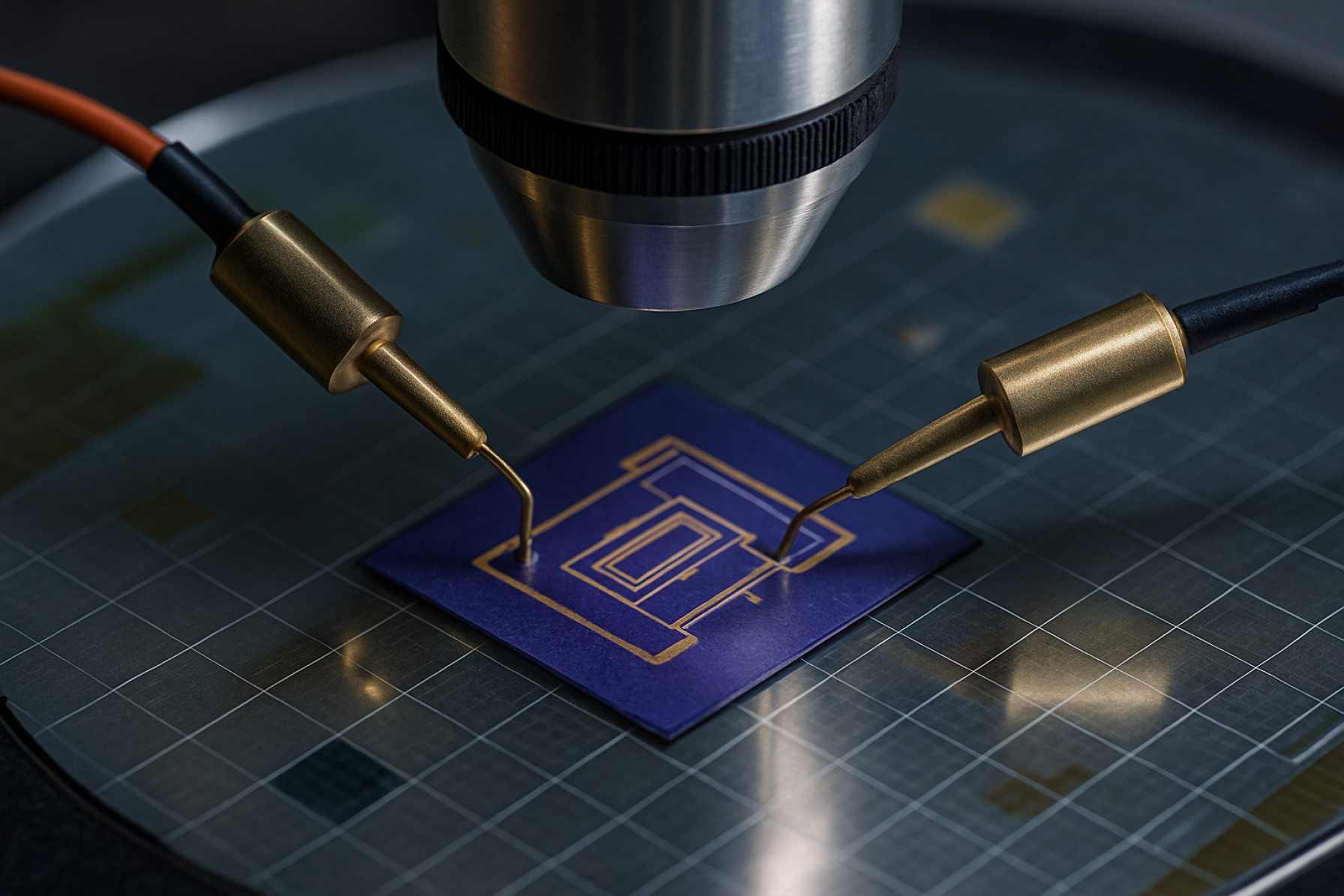

Piezoelectric MEMS (Micro-Electro-Mechanical Systems) resonator fabrication is a rapidly evolving field, driven by the demand for miniaturized, high-performance frequency control and sensing components in wireless communications, timing, and sensor applications. The core of these devices is the integration of piezoelectric materials—such as aluminum nitride (AlN), scandium-doped aluminum nitride (ScAlN), and lead zirconate titanate (PZT)—onto silicon substrates using advanced microfabrication techniques. As of 2025, the industry is witnessing significant advancements in both materials engineering and process integration, enabling higher quality factors (Q), lower motional resistance, and improved manufacturability.

The fabrication process typically begins with the deposition of a thin piezoelectric film onto a silicon wafer, often using sputtering or chemical vapor deposition (CVD) methods. AlN remains the dominant material due to its CMOS compatibility and low acoustic loss, but ScAlN is gaining traction for its enhanced piezoelectric coefficients, which translate to higher electromechanical coupling and improved device performance. Companies such as Qorvo and TDK Corporation are at the forefront of commercializing ScAlN-based MEMS resonators, leveraging proprietary deposition and patterning techniques to achieve uniformity and scalability.

Patterning of the resonator structures is accomplished through photolithography and etching, with deep reactive ion etching (DRIE) being widely used to define high-aspect-ratio features and release the resonant structures from the substrate. The integration of piezoelectric films with metal electrodes—typically molybdenum or platinum—requires precise control to minimize interface defects and maximize energy transfer. Murata Manufacturing and STMicroelectronics are notable for their advanced MEMS process flows, which include wafer-level encapsulation and hermetic sealing to protect the resonators from environmental contaminants and ensure long-term stability.

Recent years have also seen the adoption of wafer-level packaging and through-silicon via (TSV) technologies, enabling higher integration density and improved electrical performance. The move towards 200 mm and even 300 mm wafer processing, as reported by leading foundries, is expected to further reduce costs and support the scaling of MEMS resonator production for mass-market applications.

Looking ahead, the next few years will likely bring further improvements in material quality, process automation, and integration with CMOS circuits. The ongoing collaboration between device manufacturers and equipment suppliers is expected to yield new fabrication solutions that address the challenges of yield, reliability, and performance at scale. As 5G, IoT, and automotive electronics continue to expand, the role of advanced piezoelectric MEMS resonator fabrication will become increasingly central to the electronics supply chain.

Material Innovations: Advances in Piezoelectric Thin Films and Substrates

The fabrication of piezoelectric MEMS resonators is undergoing significant transformation in 2025, driven by advances in thin film materials and substrate engineering. The industry is witnessing a shift from traditional bulk piezoelectric materials, such as quartz, to advanced thin films like aluminum nitride (AlN), scandium-doped aluminum nitride (ScAlN), and lead zirconate titanate (PZT). These materials offer superior electromechanical coupling, higher frequency operation, and compatibility with standard CMOS processes, which are critical for next-generation wireless communication, timing, and sensing applications.

AlN remains the dominant material for commercial MEMS resonators due to its excellent thermal stability, low acoustic loss, and established deposition techniques. Companies such as Qorvo and Murata Manufacturing Co., Ltd. have integrated AlN-based resonators into RF filters and timing devices, leveraging their high yield and reliability. However, the industry is rapidly adopting ScAlN, which introduces scandium into the AlN lattice, significantly enhancing the piezoelectric coefficient and enabling higher performance at smaller device footprints. TDK Corporation and Akoustis Technologies, Inc. are among the leaders in commercializing ScAlN-based MEMS resonators, with ongoing investments in scalable sputtering and atomic layer deposition (ALD) processes to improve film uniformity and reduce defects.

PZT thin films, known for their high piezoelectric response, are also gaining traction, particularly in applications requiring large actuation or sensing capabilities. The challenge remains in integrating PZT with silicon substrates while maintaining CMOS compatibility and minimizing lead content for environmental compliance. STMicroelectronics and Robert Bosch GmbH are actively developing lead-reduced and lead-free PZT alternatives, as well as exploring sol-gel and pulsed laser deposition (PLD) techniques for high-quality film growth.

Substrate innovation is equally pivotal. The use of high-resistivity silicon, silicon-on-insulator (SOI), and sapphire substrates is expanding, as these materials reduce acoustic losses and parasitic capacitance, thereby improving resonator Q-factors and frequency stability. ROHM Co., Ltd. and Siltronic AG are advancing substrate manufacturing to support the stringent requirements of MEMS resonator integration.

Looking ahead, the next few years will see further optimization of deposition techniques, such as pulsed DC sputtering and ALD, to enable wafer-scale uniformity and integration with advanced packaging. The convergence of material and substrate innovations is expected to drive the proliferation of MEMS resonators in 5G/6G, IoT, and automotive radar, with industry leaders and new entrants alike pushing the boundaries of miniaturization, performance, and manufacturability.

Fabrication Techniques: State-of-the-Art Processes and Yield Optimization

The fabrication of piezoelectric MEMS resonators has advanced significantly in recent years, driven by the demand for high-performance frequency control and sensing components in wireless communications, timing, and IoT applications. As of 2025, state-of-the-art processes focus on achieving high yield, device miniaturization, and integration with CMOS technologies, while maintaining stringent performance and reliability standards.

The core of piezoelectric MEMS resonator fabrication involves the deposition and patterning of piezoelectric thin films—most commonly aluminum nitride (AlN) and scandium-doped aluminum nitride (ScAlN)—on silicon or silicon-on-insulator (SOI) substrates. Companies such as Qorvo and Murata Manufacturing Co., Ltd. have established high-volume production lines for bulk acoustic wave (BAW) and film bulk acoustic resonator (FBAR) devices, leveraging advanced sputtering and atomic layer deposition (ALD) techniques to achieve uniform, high-quality films with precise thickness control. The introduction of ScAlN has enabled higher electromechanical coupling coefficients, which translates to improved device performance and broader application potential.

Lithography and etching processes have also seen notable improvements. Deep reactive ion etching (DRIE) is widely used to define resonator structures with high aspect ratios and smooth sidewalls, critical for minimizing energy loss and maximizing Q-factor. TDK Corporation and STMicroelectronics have reported advances in wafer-level packaging and hermetic sealing, which are essential for protecting MEMS resonators from environmental contaminants and ensuring long-term stability.

Yield optimization remains a central focus, as MEMS resonator fabrication involves multiple complex steps susceptible to particle contamination, film stress, and process variation. Leading manufacturers employ in-line metrology, statistical process control, and machine learning-based defect detection to enhance yield and reduce variability. Robert Bosch GmbH and Infineon Technologies AG are notable for integrating advanced process monitoring and automation in their MEMS foundries, contributing to higher throughput and lower cost per die.

Looking ahead to the next few years, the industry is expected to further refine integration of piezoelectric MEMS resonators with CMOS circuits, enabling more compact and power-efficient system-in-package (SiP) solutions. The adoption of new piezoelectric materials and continued scaling of device dimensions will likely drive further improvements in performance and manufacturability. As the market for 5G, automotive radar, and precision timing expands, the emphasis on robust, scalable, and cost-effective fabrication techniques will remain paramount for industry leaders.

Competitive Landscape: Leading Manufacturers and Strategic Alliances

The competitive landscape for piezoelectric MEMS resonator fabrication in 2025 is characterized by a dynamic interplay among established semiconductor manufacturers, specialized MEMS foundries, and emerging technology firms. The sector is witnessing intensified activity as demand for high-performance, miniaturized timing and frequency control components accelerates, driven by applications in 5G, IoT, automotive, and wearable electronics.

Among the global leaders, Qorvo stands out with its advanced piezoelectric MEMS resonator technology, leveraging its expertise in RF solutions and MEMS process integration. Qorvo’s acquisition of Resonant Inc. in 2022 has further strengthened its intellectual property portfolio and manufacturing capabilities, positioning the company as a key supplier for next-generation wireless and timing solutions. Similarly, Murata Manufacturing Co., Ltd. continues to expand its MEMS-based timing device offerings, building on its deep experience in ceramic and piezoelectric materials. Murata’s investments in MEMS process innovation and vertical integration have enabled it to deliver high-volume, reliable resonators for consumer and industrial markets.

Another major player, TDK Corporation, leverages its longstanding expertise in electronic components and materials science to develop piezoelectric MEMS resonators with a focus on miniaturization and low power consumption. TDK’s strategic alliances with foundries and system integrators have facilitated the rapid commercialization of MEMS timing devices, particularly for mobile and automotive applications. STMicroelectronics is also active in this space, offering MEMS resonators as part of its broader MEMS sensor and actuator portfolio, and collaborating with ecosystem partners to accelerate adoption in industrial and consumer electronics.

In the United States, SiTime Corporation is a prominent innovator, specializing exclusively in MEMS-based timing solutions. SiTime’s proprietary piezoelectric MEMS fabrication processes and its focus on high-precision, ultra-reliable resonators have enabled it to capture significant market share, particularly in high-end networking, automotive, and IoT segments. The company’s strategic partnerships with leading semiconductor foundries and OEMs underpin its robust supply chain and rapid product development cycles.

Looking ahead, the competitive landscape is expected to evolve through increased collaboration between device manufacturers, foundries, and material suppliers. Strategic alliances—such as joint development agreements and co-investments in advanced MEMS fabrication facilities—are anticipated to accelerate innovation and address challenges related to yield, scalability, and integration with CMOS processes. As the market matures, differentiation will hinge on the ability to deliver resonators with superior frequency stability, low phase noise, and extended operational lifetimes, tailored for emerging applications in edge computing, autonomous vehicles, and next-generation wireless infrastructure.

Market Size and Growth Projections: CAGR Analysis Through 2030

The global market for piezoelectric MEMS (Micro-Electro-Mechanical Systems) resonator fabrication is poised for robust growth through 2030, driven by escalating demand in wireless communications, timing devices, and sensor applications. As of 2025, the sector is witnessing a transition from traditional quartz-based resonators to MEMS-based alternatives, primarily due to the latter’s advantages in miniaturization, integration, and power efficiency. This shift is particularly evident in the proliferation of 5G infrastructure, IoT devices, and advanced automotive electronics, all of which require high-performance, compact, and reliable frequency control components.

Key industry players such as Qorvo, Murata Manufacturing Co., Ltd., and TDK Corporation are actively expanding their MEMS resonator portfolios, investing in new fabrication facilities, and refining thin-film piezoelectric deposition techniques. Qorvo has notably advanced its Bulk Acoustic Wave (BAW) and Surface Acoustic Wave (SAW) MEMS resonator technologies, targeting high-frequency applications in mobile and infrastructure markets. Murata Manufacturing Co., Ltd. continues to scale its piezoelectric MEMS production, leveraging proprietary materials and process integration to meet the stringent requirements of next-generation wireless modules. TDK Corporation is also investing in MEMS process innovation, focusing on miniaturization and mass production for consumer and industrial electronics.

Current market analyses indicate a compound annual growth rate (CAGR) in the range of 8% to 12% for piezoelectric MEMS resonator fabrication through 2030, with the Asia-Pacific region—particularly Japan, South Korea, and China—emerging as both major manufacturing hubs and end-user markets. This growth is underpinned by the rapid expansion of consumer electronics, automotive ADAS (Advanced Driver-Assistance Systems), and industrial automation sectors, all of which increasingly rely on MEMS-based timing and sensing solutions.

Looking ahead, the next few years are expected to see further acceleration in market growth as fabrication processes mature and economies of scale are realized. The adoption of advanced piezoelectric materials such as aluminum nitride (AlN) and scandium-doped AlN is anticipated to enhance device performance and yield, further broadening the application landscape. Strategic collaborations between device manufacturers and foundries are also likely to intensify, aiming to streamline supply chains and reduce time-to-market for new MEMS resonator products.

In summary, the piezoelectric MEMS resonator fabrication market is set for sustained expansion through 2030, propelled by technological innovation, rising end-user demand, and the ongoing shift toward integrated, miniaturized electronic systems.

Emerging Applications: 5G, IoT, Automotive, and Medical Devices

The fabrication of piezoelectric MEMS resonators is rapidly evolving to meet the stringent demands of emerging applications in 5G communications, IoT, automotive electronics, and medical devices. As of 2025, the sector is characterized by a strong push towards miniaturization, integration, and mass manufacturability, with leading industry players and foundries investing in advanced process technologies and materials.

In the 5G and IoT domains, the need for high-frequency, low-loss, and thermally stable resonators is driving the adoption of thin-film piezoelectric materials such as aluminum nitride (AlN) and scandium-doped AlN (ScAlN). These materials enable the fabrication of resonators with high quality factors (Q) and frequency stability, essential for RF front-end modules in smartphones, base stations, and connected devices. Companies like Qorvo and Skyworks Solutions are actively developing and commercializing MEMS-based RF filters and resonators, leveraging their expertise in thin-film deposition, lithography, and wafer-level packaging.

Automotive applications, particularly in advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communications, require resonators that can withstand harsh environments and wide temperature ranges. The automotive sector is increasingly adopting MEMS resonators for timing and sensing functions, with companies such as STMicroelectronics and NXP Semiconductors integrating piezoelectric MEMS into their automotive-grade product portfolios. These companies emphasize robust fabrication processes, including hermetic wafer-level packaging and rigorous reliability testing, to ensure compliance with automotive standards.

In the medical device sector, the miniaturization and biocompatibility of MEMS resonators are critical for implantable and wearable devices. Fabrication techniques are being refined to produce ultra-thin, low-power resonators suitable for wireless communication and sensing in medical implants. TDK Corporation and Murata Manufacturing are notable for their ongoing development of piezoelectric MEMS components tailored for medical and health monitoring applications, focusing on high-yield, contamination-free processes.

Looking ahead, the next few years are expected to see further advances in scalable fabrication methods, such as monolithic integration of MEMS resonators with CMOS circuits and the adoption of new piezoelectric materials for enhanced performance. Industry collaborations and investments in 200mm and 300mm MEMS wafer fabs are anticipated to accelerate the mass production of piezoelectric MEMS resonators, supporting the proliferation of 5G, IoT, automotive, and medical technologies worldwide.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global landscape for piezoelectric MEMS resonator fabrication in 2025 is marked by strong regional specialization, with North America, Europe, and Asia-Pacific each playing distinct roles in technology development, manufacturing, and market adoption. The sector is driven by demand for ultra-low-power timing devices in wireless communications, IoT, automotive, and industrial applications.

North America remains a hub for innovation and early commercialization, with the United States hosting leading players such as Qorvo (following its acquisition of Resonant Inc. and RFMD), and Texas Instruments. These companies are advancing piezoelectric MEMS resonator design and integration, particularly for RF filters and timing solutions. The region benefits from a robust semiconductor ecosystem and close ties to major system integrators. In 2025, North American firms are expected to focus on scaling up production and expanding into automotive and industrial IoT, leveraging their expertise in high-reliability and high-frequency MEMS.

Europe is characterized by a strong emphasis on research, prototyping, and niche applications. Companies such as STMicroelectronics (headquartered in Switzerland and France) and Infineon Technologies (Germany) are investing in piezoelectric MEMS for automotive safety, industrial automation, and medical devices. European initiatives are often supported by collaborative R&D programs and public funding, fostering innovation in materials (e.g., AlN, ScAlN) and wafer-level packaging. The region is expected to see increased pilot production and partnerships with local automotive and industrial OEMs through 2025 and beyond.

Asia-Pacific leads in high-volume manufacturing and rapid commercialization. Japan, South Korea, Taiwan, and China are home to major foundries and IDMs such as TDK Corporation (Japan), Murata Manufacturing (Japan), and Samsung Electronics (South Korea). These companies are scaling up piezoelectric MEMS resonator production for consumer electronics, smartphones, and wearables, leveraging advanced packaging and cost-effective manufacturing. China is rapidly increasing its domestic capabilities, with government support for MEMS foundries and a focus on supply chain localization. The Asia-Pacific region is projected to maintain its dominance in volume production and cost leadership through 2025.

Rest of World regions, including parts of the Middle East and Latin America, are primarily consumers of piezoelectric MEMS resonators, with limited local fabrication. However, some countries are exploring partnerships and technology transfer agreements to build domestic MEMS capabilities, particularly for strategic sectors such as telecommunications and defense.

Looking ahead, regional collaboration and supply chain resilience will be key themes, as geopolitical factors and technology sovereignty concerns shape investment and partnership strategies in piezoelectric MEMS resonator fabrication.

Challenges and Barriers: Reliability, Scalability, and Cost Factors

The fabrication of piezoelectric MEMS resonators faces several persistent challenges and barriers, particularly in the areas of reliability, scalability, and cost—factors that are critical as the industry moves into 2025 and beyond. As demand for high-performance, miniaturized timing and sensing components grows across sectors such as telecommunications, automotive, and consumer electronics, manufacturers are under increasing pressure to address these issues.

Reliability remains a central concern, especially as piezoelectric MEMS resonators are deployed in mission-critical applications. Device longevity is often limited by material fatigue, stiction, and degradation of piezoelectric thin films, such as aluminum nitride (AlN) and scandium-doped AlN (ScAlN). Leading manufacturers like Qorvo and TDK Corporation have invested in advanced deposition and encapsulation techniques to improve film uniformity and reduce defect densities, but achieving consistent performance over billions of cycles remains a technical hurdle. Additionally, packaging-induced stress and environmental factors such as humidity and temperature cycling can further impact device stability and yield.

Scalability is another significant barrier. While piezoelectric MEMS resonators offer advantages in integration and size, scaling up production to meet global demand is non-trivial. The fabrication process requires precise control over thin-film deposition, etching, and patterning at the wafer level. Companies like STMicroelectronics and Murata Manufacturing Co., Ltd. have developed proprietary MEMS process flows and invested in 200mm and 300mm wafer fabrication lines to increase throughput. However, maintaining tight tolerances and high yields at scale, especially for complex multi-layer structures, continues to challenge even the most advanced foundries.

Cost factors are closely tied to both reliability and scalability. The use of high-purity piezoelectric materials, advanced lithography, and specialized packaging drives up manufacturing costs. While economies of scale and process optimization are gradually reducing per-unit costs, piezoelectric MEMS resonators still face price competition from established quartz-based solutions. Companies such as SiTime Corporation are leveraging monolithic integration and CMOS-compatible processes to lower costs and enable broader adoption, but the transition to mass-market applications will require further cost reductions.

Looking ahead, the industry is expected to focus on innovations in materials engineering, process automation, and in-line quality control to address these challenges. Collaborative efforts between device manufacturers, foundries, and equipment suppliers will be essential to achieve the reliability, scalability, and cost targets necessary for widespread adoption of piezoelectric MEMS resonators in the coming years.

Future Outlook: Disruptive Trends, R&D Roadmaps, and Investment Opportunities

The landscape of piezoelectric MEMS resonator fabrication is poised for significant transformation in 2025 and the coming years, driven by advances in materials science, process integration, and the growing demand for ultra-miniaturized, high-performance timing and sensing solutions. The convergence of 5G, IoT, and edge computing is accelerating the need for MEMS resonators with higher frequency stability, lower power consumption, and improved manufacturability.

A key disruptive trend is the shift toward advanced piezoelectric materials, particularly scandium-doped aluminum nitride (ScAlN), which offers enhanced electromechanical coupling and higher Q-factors compared to traditional aluminum nitride (AlN) or zinc oxide (ZnO). Leading manufacturers such as Qorvo and TDK Corporation are actively developing and scaling ScAlN-based MEMS resonators, targeting applications in RF filters and precision timing. These materials enable higher frequency operation and improved integration with CMOS processes, which is critical for next-generation wireless and sensor platforms.

On the process side, the industry is witnessing a move toward wafer-level packaging and monolithic integration, reducing parasitics and improving device reliability. STMicroelectronics and Murata Manufacturing are investing in advanced MEMS fabrication lines that leverage deep reactive ion etching (DRIE), atomic layer deposition (ALD), and high-throughput lithography to achieve tighter process control and higher yields. These process innovations are expected to lower costs and enable mass adoption in consumer and automotive markets.

R&D roadmaps for 2025-2028 emphasize the co-integration of MEMS resonators with ASICs and RF front-end modules, as well as the development of multi-frequency and programmable resonator arrays. SiTime Corporation, a pioneer in MEMS timing, is expanding its portfolio with temperature-compensated and ultra-low jitter resonators, aiming to replace legacy quartz devices in critical infrastructure and data center applications. The company’s ongoing investments in MEMS process technology and proprietary packaging are expected to set new benchmarks for performance and miniaturization.

Investment opportunities are robust, with strategic funding flowing into startups and established players focused on novel piezoelectric materials, heterogeneous integration, and AI-driven process optimization. Industry alliances and consortia, such as those led by Semiconductor Industry Association, are fostering collaboration on standardization and supply chain resilience, which will be crucial as MEMS resonators become foundational to next-generation electronics.

In summary, the next few years will see piezoelectric MEMS resonator fabrication evolve rapidly, with disruptive materials, advanced integration, and strong investment shaping a highly competitive and innovative market landscape.

Sources & References

- STMicroelectronics

- Murata Manufacturing

- Akoustis Technologies, Inc.

- Robert Bosch GmbH

- ROHM Co., Ltd.

- Siltronic AG

- Infineon Technologies AG

- SiTime Corporation

- Skyworks Solutions

- NXP Semiconductors

- Texas Instruments

- Semiconductor Industry Association